Summary: This is an overview of existing solutions for retroactive funding – also known as outcomes-based funding: What are the main problems that each solution targets and how does it try to solve them? You may learn of new funding models or better understand the differences between them. The article is particularly interesting for donors of all sizes, grantmakers, and investors, as well as project developers across global development, forecasting, and AI safety.

Disclaimer: This article covers many projects in the retroactive funding space. I’m a cofounder of AI Safety Impact Markets, so that’s the project that I know really well. I I’m much less knowledgeable of the other projects.

This is an edited transcript of an eponymous talk. I’ve held this talk at EAGx Berlin 2023 among other venues.

The Problems

The basic idea behind retroactive funding is that there is some sort of buyer (also known as retrofunder) that provides funding as an incentive. This could be a government, some sort of protocol in the blockchain space, a foundation, a startup in a growth sector that’s doing R&D, a company that has a corporate social responsibility (CSR) budget, impact investors, or donors – all sorts of altruistic actors. The idea is always to commit to paying out some sort of reward to create an incentive for project developers and investors. (I’ll always say investor when someone is at least partially profit-oriented and funder or buyer otherwise.)

With this incentive in place, these project developers can go to investors and ask for funding in the form of equity or debt in order to realize their project. Then, if the project is successful, the buyers can reward both of these parties. These financial flows are indicated in the diagram – but of course, they only happen conditionally on this project actually producing something that the buyer values.

This solves a few different problems, and depending on the temperament of the buyers, some of these might be relevant in particular cases or they might not be relevant.

Knowledge & Overhead

One problem that is particularly important for us at AI Safety Impact Markets is what has been called the long-tail problem, a particular kind of problem that can be classed under problems that relate to an imbalance in knowledge about a field (in particular very local conditions relevant to its implementation) or conversely the overhead that a funder would have to invest to acquire all of that local knowledge, for example by hiring a lot of different specialists.

The long-term problem in particular describes the problem that there are often a lot of small startup projects, independent researchers (in our case), or really small think tanks. These projects are so small and so many that the large funders can’t review all of them without incurring disproportionate costs. So they could just give those projects money at random – but on average these projects are not value valuable enough that it would be cost-effective for the buyers to do that. It would also attract a lot of fraudsters and bad actors to the space.

So the funders would have to invest a lot of time investigating these projects to find even one that they could make a grant to. And this grant would have to be relatively small. They’re much better off ignoring this whole space, even though there are gems in it, ignoring the whole long tail and just making a few big grants to organizations that already have a proven track record: well-established bigger organizations.

How do we serve this long tail? We can set an incentive in order to attract investors to the space. These investors will have specific private information about the individual few projects that they want to support. These investors might have particular special knowledge or might be active in particular spaces where they know the people really well. So they will have very good local information about a few of these projects. And taken together all of these investors will have specific knowledge about a lot of these projects in this long-tail. They can provide this knowledge to the market and can even make a profit off of it. In some cases, buyers will be ready to pay a premium for this service, because, even so, it’ll be cheaper than the counterfactual where they have to invest tremendous effort to try to acquire all this specialized expertise themselves. In return, they can capitalize on the extremely high-value opportunities in the long tail that would otherwise be very hard for them to recognize.

Access to Talent

Access to talent is a pretty specific case where a startup in a growth sector wants to get some R&D done for which they would hypothetically have to attract top talent in some space, maybe even university professors. Being a startup, they don’t have the funding to do that. They don’t have the big name that it would be interesting for these people to work for either, so this is basically not an option for them.

But the startup can become its own outcome buyer! Some version of the startup in the future has a lot of money. The startup has a lot of money in the futures in which it is actually successful in realizing its project. So it can make a binding commitment to reward the people who have contributed to that success, in the futures where they achieve the success. (That can be legally formalized and standardized in our setup.) It enables these startups to draw on this top talent to produce the open-access research that helps them get off the ground without the talent actually having to work for the startup or otherwise speculate on its success in particular. Investors will speculate on the success of the whole space (rather than a particular startup), and the researchers can get their funding from the investors.

This is particularly interesting for startups in growth sectors where they can just produce open-access research because competition is not such a big factor for them. Competitors are just other people who help them with the marketing of the whole sector.

Risk-Aversion

Now finally, risk aversion. This is currently the major use for impact markets. There are already a lot of government actors and large foundations that are using retroactive funding (or outcome-based funding) in order to realize positive change in the world. And they’re often doing this because they are risk-averse. They want to realize change with low variance and want to outsource the carrying of the risk to for-profit investors. And that’s why they are using retroactive funding and why they’re also happy to pay a premium.

The Ideal Solution

The whole ecosystem that I imagine around these mechanisms is a bit more complex. It’s the ideal solution that I envision at the moment. It’s copying what works for the carbon credit space, following the analogy that we want to establish something like carbon credits but for any kind of positive social impact.

Clear Standards for Claims

Some of the key things that I want to see are that we have clear standards in order to get buyers into the space. In order to get buyers or investors into the space, you need to have clear standards where everyone can agree on what it is that they’re trading in the first place and what it is that these buyers are buying or what these investors are investing into. Without a shared understanding, it’s going to be very hard to convince investors and buyers to purchase these constructs.

Public Registry and Ledger

What I think we’ll also need is a public registry and a public ledger in order to prevent fraud – and I’m mostly thinking of double-issue fraud here. The sort of fraud where someone is trying to sell more than 100% of some positive impact they have generated, or maybe even that some other party has generated.

They might, for example, issue a claim to have realized some impact on one marketplace and then issue that impact claim again on another marketplace. And if these marketplaces are sufficiently disconnected, no one might notice that these impact claims overlap or are identical. And then they can sell more than 100% of what they own.

They might also sell shares in these impact claims privately to different buyers and so sell more than 100% of them because these buyers don’t know of each other, and don’t know that, in aggregate, they have bought more than 100% of the impact claim.

These are things that can be prevented by having all of these transactions and all of these claims in public where they can be vetted. And that is something that the patent system currently struggles with. But we can learn from the problems of the patent system and hopefully prevent a lot of these problems from the get-go in impact markets.

With all the standardization and registries and so on, we are in the top right corner of this diagram, where it says standardization. That is something that I would like to see done by these standard-setting firms.

Evaluation of the Total Impact

When it comes to evaluation – that’s in the top left corner – I would like to see evaluations of the total impact and not only our particular cherry-picked outcomes. Because it can happen that some outcome, some positive outcome, comes at the expense of another positive outcome. And if a charity realizes some positive outcome but thereby harms some other positive outcome, then that outcome should trade at a lower valuation than an outcome that has been achieved without such a negative externality.

And there’s also disagreement over what outcomes are positive in the first place. So if outcomes are uncontroversially positive, they should also be valued higher than outcomes that are controversial in terms of whether they’re positive or not.

Prediction Markets

Prediction markets can also help debias these evaluations in particular cases. If you have questions about that, you can ask them in the comments. I think prediction markets should also play an important role in these markets. The prediction market should start as early as possible, the moment a project starts fundraising.

A Small Number of Markets

I think that we should aim for having as few markets as possible – for deeper liquidity, but mostly for the aforementioned reasons of incentivizing moral trade.

When you evaluate projects by their total impact, then you’re incentivizing the project developers to morally trade with other project developers who might have different moral opinions. So this incentivization is a very valuable aspect of having fewer markets. But then fewer markets also provide deeper liquidity, so it’s a win-win.

Deflationary Auctions for Investors

I think we need deflationary auctions for investors so that they try to come in as early as possible. Currently, charities struggle with the problem that donors wait out other donors. Donors try to keep their money in the hope that other donors will already fund some charity, and then only donate if it’s absolutely necessary because otherwise they can keep their money for some niche project that no one else would fund. That is basically a defection in an assurance game.

So we want to establish an auction mechanism that incentivizes the investors to invest as quickly as possible into charitable projects so that they can be funded more quickly. That way, the uncertainty for the charities over whether they will or will not reach certain funding goals is as little as possible and lasts for as short of a period as possible. We, for example, use a bonding curve auction for this purpose, which absolves the user from having to deal with the details of the auction mechanism.

Assurance and Coordination Among Buyers

This, I think, is very important, for the same reason, except that buyers are not profit-oriented. So you can’t just use an auction mechanism for this, but there are of course assurance contracts you can establish – assurance contracts or even dominant assurance contracts. Or you can use the S-Process. There are nice videos by Andrew Critch on YouTube on how the S-Process solves this problem.

It uses marginal utility functions, and many people will probably not have clear intuitions of what their marginal utility function is. So I imagine that it might be possible to create an 80/20 version of the S-Process that is suitable for use with a wide audience of lay donors. But there are also other coordination mechanisms that are already tested on wide populations, for example, Pol.is could serve to order outcomes by their uncontroversiality. And that is something that evaluators could use.

Then of course my ecosystem would also include exchanges and retailers to do the sales and for all these auctions to take place. So this is the vision for what I would like this ecosystem to look like. And of course, that vision is evolving. People might have different opinions on what exactly this should look like and which of these are actually important. I also imagine that over time I will update on a lot of these. But at the moment I think that these are the most important aspects of this ecosystem.

The Vision

The long-term vision is to integrate charities into the for-profit sector. Currently, there is an unnecessary separation between them. If charities can incorporate not as non-profits but as public benefit corporations, they can harness this ecosystem and generate more positive outcomes more quickly.

Impact Certificates as “Patents on Impact”

Building blocks for that are what we usually call impact certificates. You can think of them basically as “patents on impact.”

The problem with ideas is that they are just public goods. So by default, an idea would not be monetizable for a person. So, by extension, a person with an idea would not be able to attract seed funding to get this idea off the ground, because no profit-oriented investor would want to invest in a public good like that.

But then if you have a government that assures you that if you register this thing as a patent and you’re the first person to register it as a patent and it’s actually yours, then they will ensure that no one else commercializes the idea unless they license it from you.

We want to establish the same principle where, if you have a public good or maybe network good or something of this sort and you make it artificially excludable through this quasi-patent on impact, then investors can be incentivized to come in and provide the seed funding for you. So it’s about creating artificial excludability for impact.

I imagine that most of the trades and most of the incentive setting from buyers should probably not happen on the level of the individual impact certificates because they should probably be traded more like products where a charity puts out a lot of small impact certificates and just sells them whole, not fractionally.

If you’re running a think tank, then that’d be one impact certificate per blog post or paper or something that you put out. That way it’s really clear who the authors are, who has contributed to it, and who (a priori) owns which fraction of it. I’d like to keep them as small as possible, and as easy to intuitively grasp as possible so that there are also cultural norms that enshrine ownership.

Impact Credits as Financial Instrument

All of the actual incentive-setting and trades and so on should probably rather happen on the level of the impact credits. That’s what we are mostly focused on at the moment, what we want to establish. Our long-term vision is to have a market, like the carbon credit market, but for impact credits for any kind of positive impact where buyers like governments can just set their limit orders.

Investors that have invested in some sort of successful altruistic project can gain their impact credits from the validators, auditors, or evaluators and sell them into the buy orders that these governments or foundations have on these markets. I think that’s the vision that will probably streamline this ecosystem as much as possible, mostly going off the example of carbon credits.

The Landscape

What follows is my overview of the landscape.

Outputs, Outcomes, or Impact

First of all, I want to make a distinction between outputs, outcomes, and impact.

Here is one example of an output-based contractor: If you go to a restaurant, you pay the restaurant for the food they make for you. But if you go into the restaurant already relatively full and you’re super full afterward, then you don’t pay them more than if you go into the restaurant completely famished, and you’re just a bit full afterward. So it’s not about the outcome for you that you pay them for, but the output.

In contrast, what is already relatively well established is outcome-based funding.

There are the well-established social and development impact bonds that governments and large foundations are using to incentivize altruistic projects or improvements in living standards in various countries, or nationally for various public goods projects. These are usually focused on outcomes, so very specific metrics that project developers need to reach.

OutcomesX, as the name says, is focused on outcomes. They have the Impact Genome in the background, which is a project that has standardized a lot of outcomes, to the tune of 170+. It’s a very sophisticated system that they’re already using that is completely focused on outcomes.

I have not managed to get in touch with Ixo, but they also seem to have a pretty mature system that I think is outcomes-based. There is a podcast interview with the founders of Ixo. That is probably a really good source of information on Ixo.

Then there are of course carbon credits. Carbon credits are our paragon of how we think this market should work, except that we want to focus it on impacts.

There are advanced market commitments, another example where incentives are created for outcomes.

Prizes are used for all sorts of different things. So there’s no clear line to draw there whether prizes are used for outputs, outcomes, or impacts. There have probably been plenty of prizes for all of these.

There is the Retroactive Public Goods Funding project of the Optimism layer 2 blockchain on Ethereum. They are retrofunding things, efforts that have helped their ecosystem. That’s a very nice example of something that could just as well work for a for-profit. Optimism is a foundation, but the principle is universal, at least in growth sectors. A very nice example of this use of impact markets.

I’m not sufficiently briefed on the details of how they conduct their evaluations (and maybe I wouldn’t understand them if I were briefed on them) because I don’t have that in-depth knowledge of their tech stack unfortunately. So that’s why I’m leaving it a bit open whether they are focused on outputs, outcomes, or impact. I would imagine that they’re probably rewarding all three of them in different cases.

We’ve reached the last three projects that I will describe in some more detail, in particular, because they are focused on impact.

That’s the Hypercerts Foundation, they are standardizing hypercerts, which will hopefully provide what they call the basic data layer for this whole ecosystem. It’s so foundational that it can be used for basically anything, but they’re very interested in making this ecosystem about impact and not about outputs or outcomes. So they’re interested in getting the impact evaluators in their ecosystem to take all outcomes into account.

Manifund is another project that is focused on impact. I’ll mention them later in more depth.

Finally, there’s Impact Markets or AI Safety Impact Markets, our own project. Clearly, we’re focused on impacts.

Tradeability & Focus

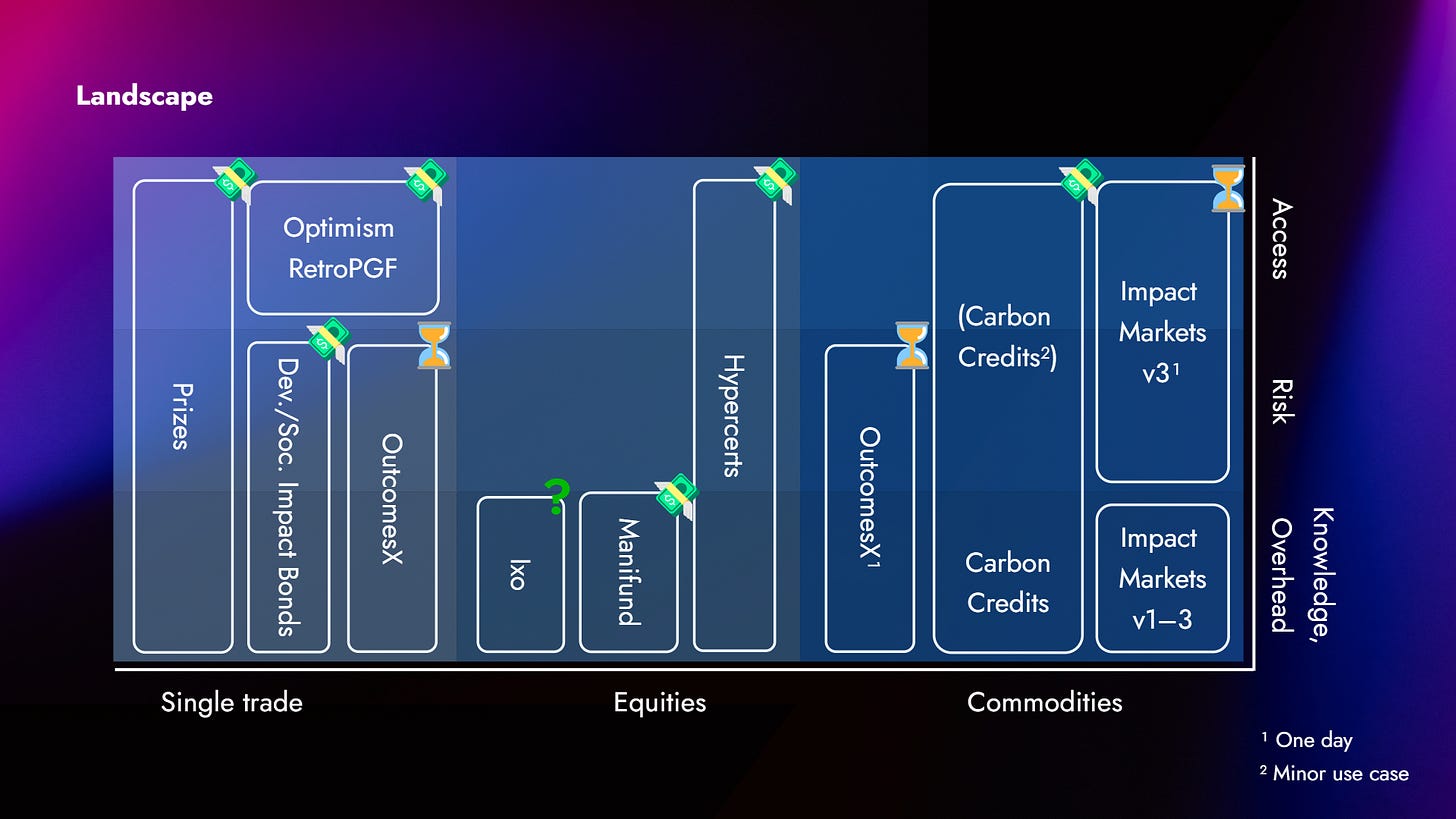

Here’s a different taxonomy. In this taxonomy, you can see on the vertical axis the particular problem that the projects are tackling. So whether it’s access, which I elucidated in the context of growth startups; whether it’s risk, the typical use case for impact markets at the moment; or whether it’s knowledge or overhead, local specialized knowledge, the use case that we are particularly focused on at the moment.

On the other axis, there is the mechanism by which these trades are happening.

So on the left, there are some simple mechanisms. They are usually not traded at all. There’s one sale happening when in the end, when a project is successful and it gets rewarded. There are exceptions, but lots of price contests, there’s just a person who does something, and then in the end they win a prize for it.

The little icons in the top right corner indicate whether it’s currently possible to make money with the system or not, in a profit-oriented fashion.

There are exceptions to that, but I still put prizes in this category.

Social and development impact bonds also oftentimes fall in this category. At most there is one investment.

I think that Optimism is also simply rewarding people at this point. That might change. OutcomesX also doesn’t have investors at the moment. That might change too; hence the second mention of OutcomesX over to the right. OutcomesX is sort of thinking about getting for-profit investors involved, but there’s nothing really on the horizon.

That brings us to equity. These can be traded around among investors, lots and lots of trades can happen here. They can be traded fractionally too. They can change hands a lot.

I don’t know whether this is the case with Ixo. I think it is. They’re doing this on the Cosmos blockchain, so I’m sort of imagining that it’s the case, but I don’t want to spread misinformation. Please try to find out yourself.

In the case of Manifold, trade is possible. I will show some screenshots later.

Hypercerts are also traded on Ethereum and maybe some L2s at this point.

But all of these are individual assets that are issued by project developers to represent excludeably the impact of their work.

That brings us over to the right side into the space of commodities.

We as AI Safety Impact Markets are of course aspiring to establish impact credits as commodities. So that’s not the status quo, but our hope is to go for that format. Currently, you also cannot make profits with our system, but then at some point hopefully when all of this is mature, we hope that we’ll have the legal basis established to make that possible.

Carbon credits have already achieved that. So if you want to sell carbon credits or gold or other commodities, you don’t have to every time register your project with the SEC.

Target Use-Cases

And here is yet another taxonomy to give you an even better overview of this landscape. This is about what these technologies are used for at the moment. Most of them are a bit bunched up down there in the deployment space.

Carbon credits are mostly used for deployment at the moment – for whatever reason.

I think development and social impact bonds are also mostly used for deployment of existing interventions rather than research and development.

OutcomesX, judging by the Impact Genome standards, seem like they are mostly dealing in all things deployment, but there are a few outcomes standards that refer to research.

From what I could gather, that’s probably also true for Ixo. Again please ascertain that yourself.

When it comes to R&D, I have classed Optimism as partially for-profit R&D. It’s not quite correct since they are a foundation, but this could hypothetically be just as well used by a for-profit.

We are currently very much situated in the Impact R&D sector, AI safety in particular. That can change. Once our system is mature, we want to be able to just open this up generally for any kind of positive impact, be it profit-oriented or not.

Hypercerts are a very foundational technology, so they also cover everything.

Prizes have been used for various different things.

And Manifold is also in principle generic. They have of course focused on particular cause areas, but it’s not so easy to distinguish them in this system.

Projects

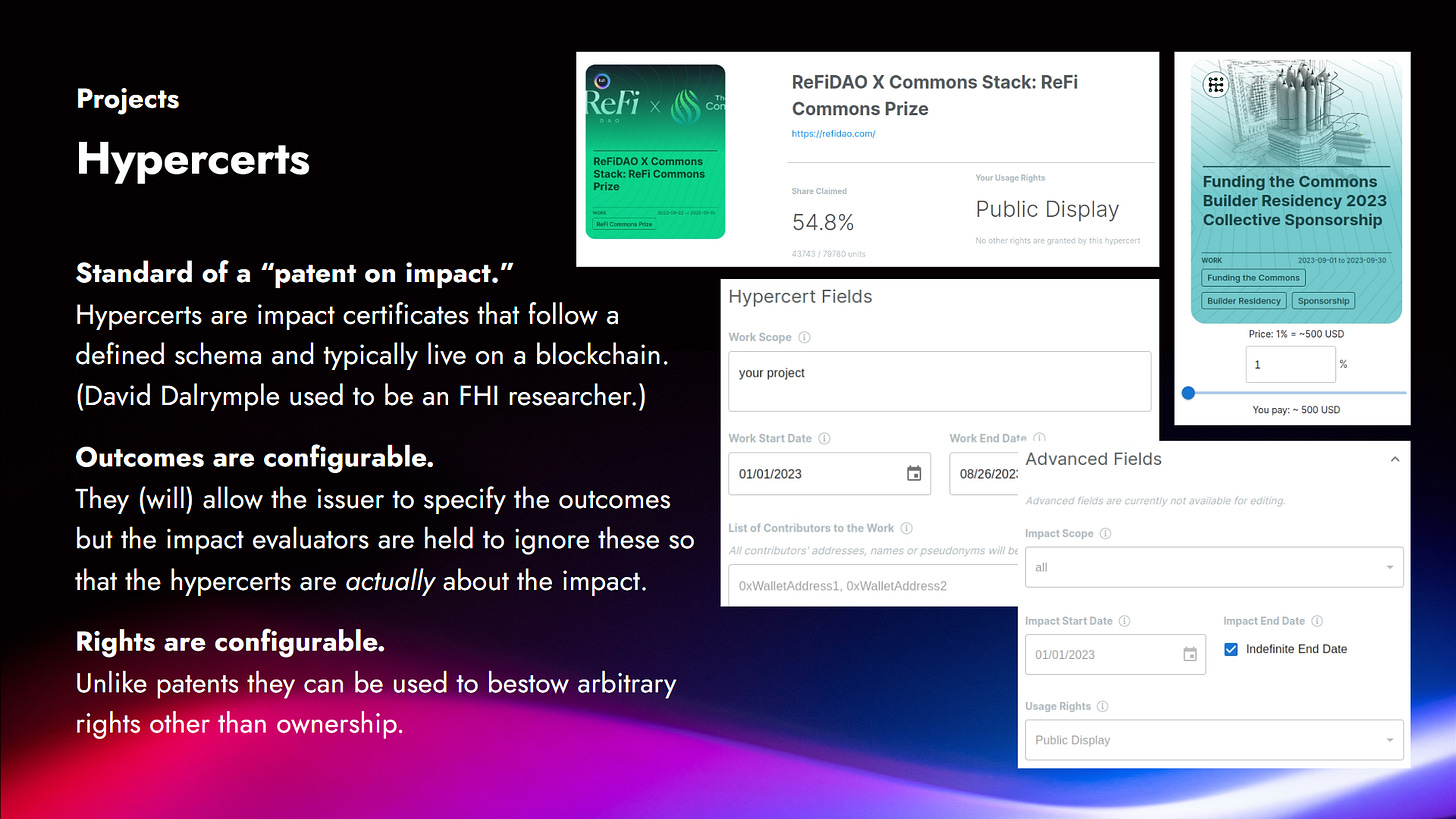

Hypercerts

Now I’d like to go a bit more in-depth on hypercerts. Earlier I mentioned standardization and the analogy of the “patent on impact.” This is exactly what hypercerts provides. Their inventor, David Dalrymple, has thought about what sort of schema would be useful for impact claims. You can think of a hypercert as a form with a few particular standardized fields.

There is a field for the description of what you’ve done; there is the period during which you’ve done the thing; there is a field for who has contributed, so who should be the co-owners of the impact initially; and there are a bunch of advanced fields.

Mostly it provides a clear standard and that is where its value lies as a foundational data layer for impact claims. So whenever someone wants to file some sort of impact claim they can now use the standard – be it on a blockchain, as it’s being used currently mostly, or just in whatever other random database. As long as it follows the standard, it establishes compatibility and that is the main benefit that hypercerts provide.

At the moment, outcomes are configurable but the people of the hypercerts team assure me that the impact evaluators will be held to take all outcomes into account regardless of what you specify there.

And interestingly rights are configurable. With this analogy to patents on impact, I’ve been referring to a right to commercialization, a right to this retractive funding, that (the right) you’re selling, licensing out, trading.

That is not necessarily the case with hypercerts. You can also just have some other right, for example public display, where whoever holds this impact certificate is allowed to display it publicly as their own. You can just configure this freely.

Hypercerts are being actively used. There are several ten thousand hypercerts in circulation and some 20,000 unique addresses are using them. So probably also thousands of people.

Hypercerts provide the basic data layer for impact claims. On top of that are attestations, valuations, and so on that provide legitimacy to particular hypercerts that deserve them.

Above that are all the different kinds of auction mechanisms, for example the S-Process that I’ve mentioned before, that can be used to allocate funding. Funding can take different shapes and can come from different sources. So this is what this nice diagram shows that I’ve lifted from a presentation by Holke of the Hypercerts Foundation.

Manifund

Then there’s Manifund. Manifund uses a hypercert-like form but it’s much simpler – just has a title, a subtitle, and a description. So if you want to make your Manifund description compatible with hypercerts, you have to include all the other mandatory fields of hypercerts in the project description.

They’re also including a few other fields that I think are not about the description of the impact claim. Some are for organizational details and to make the project easier to find.

They run this for a bunch of different cause areas. They started with the ACX Mini-Grants on forecasting. That’s why there are a lot of projects in that cause area. Then of course technical AI safety is a very popular field, so a lot of people in that space have also filed their impact claims with them.

The flow is usually that someone wants to do something, they create a project, they attract seed funding from investors, and then if they reach their funding goal, the money is paid out to them. Then they realize the project, and only when the project has succeeded, does the project page transition into the state of an actual impact claim. Then outcome buyers can come in and reward these investors by purchasing fractions of the impact claim from them.

OutcomesX

OutcomesX is a really sophisticated system that builds upon the Impact Genome, which is a decades-old system that has had a lot of time to mature and to standardize 170+ outcomes.

OutcomesX has that in the background for the standardization and the registration of impact claims. OutcomesX itself is basically the exchange or the retailer or broker for these outcome claims and allows buyers to purchase them and thereby retroactively fund the project developers. They don’t have investors yet at the moment. That is something that is potentially on the horizon, though.

The most interesting part is the level of sophistication of the standardization of the outcomes that they have achieved. Impact Genome rates the evidence by how extensive it is, by its rigor, relevance, and validity. You also get the cost at which the outcome in question has been achieved and a benchmark from among the other projects that they have in their database so that you can compare it with them.

They have a nice video that gives a really good overview of what outcomes X is doing.

AI Safety Impact Markets

Finally of course there is our own project, AI Safety Impact Markets. Our thinking has been the following: Since all of these things that have to do with equitization of impact claims are legally really difficult, what we want to start with is something that is really legally safe and simple, something that everyone can do everywhere in the world without having to worry about legal implications, where they don’t have to be accredited investors to participate in it, where the barrier to entry is as low as we can get it.

The basic intuition behind it is that capital markets reward investors for making very forward-looking prudent investments that pay off. These profits enable the investors to reinvest more capital and so have an even greater influence on price discovery. The better the investors, the greater their influence on prices. That drives the price discovery forward.

This price discovery is what we are currently completely focused on. We’re transferring it to the non-profit space. So if a donor makes particularly good donations to projects that are later successful and generate a lot of positive impact, then these donors should be rewarded for that and should have a greater weight in the funding allocation of other donations.

We do that through an organic regrantor system where the better the decisions of a donor have been (the better the donation track record of the donor), the greater the donor’s influence on the recommendations that we’re making on our platform.

So we are providing a crowdsourced charity evaluator, sort of like a Yelp or Google Reviews for charities. People who just want to donate and don’t want to do a lot of research can just follow the recommendations that the platform generates.

People who think that they have some private knowledge register their donations on the platform to build their track record. The better their track record, the greater their influence on the recommendations that the platform makes. So their incentive is to influence the recommendations on the platform in favor of the charities that they think are the most impactful ones in order to leverage others’ donations. Hence the intuition that they are quasi-regrantors for the other users of the platform.

That’s the first two phases. Now for the third and final phase.

You’ve seen this diagram before. This is where we want to get to in the end, the structures that we want to establish in our phase 3. To get there we will have to fundraise for all the legal costs that come with that and all the investigations into which country to even start this in.

Call to Action

For Investors

So if you are an impact investor or any kind of investor, this could be interesting for you. We will probably position ourselves in the standards and verification space where the revenue comes from buyers (account fees), project developers (registration and verification fees), and other evaluators/auditors (accreditation fees). We are a public benefit corporation.

For Donors

This brings me to this final call to action. If you’re interested in simply using our charity evaluator for AI safety to get donation recommendations, then that’s all live on our website, impactmarkets.io. Please just go ahead and use it.

But please also go to bit.ly/donor-interests and register that you are interested in using it, because the more interest we have registered, the greater the incentive for project scouts to actually help you with their hopefully wise recommendations for projects.

At the moment the recommendations are not super robust. We want to improve that. For that, we need these registrations of interest.

It’s a very quick one-minute form. You’ll be asked to fill in your name, email address, and your annual donation budget. You can ignore the rest of the fields if you like.

We put the aggregate, the sum of all of that, on the website. At the moment we are at $390,000, but we want to drive this up to a million or more in order to create a strong incentive for project scouts to come in and try to move that money to the projects that they think are the most impactful ones in the AI safety space.

For Project Scouts

Conversely, if you’re a project scout and you find it interesting to move some of these $390,000 that we already have, or potentially more soon, then please register your donations, bring your favorite charities that you think are the most impactful ones onto the platform, register your donations to them, and signal boost them on the platform so that other donors can see them.

That’ll make it legible to other donors that these projects are good investments and they’ll donate to them. You’re leveraging other people’s donations with your recommendations, so the time that you spend researching your donations will be even more valuable. You’ll become a regrantor for the other users of the platform.